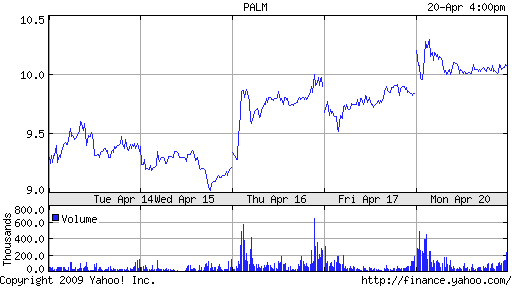

On a day that the market was down, Palm's stock broke $10. You'd think that after Friday's downgrade by Morgan Joseph (to Hold from Buy) that the stock would have retreated a little. But instead, Monday opened with good news: Bank of America/Merrill Lynch analyst Vivek Arya upped his rating on Palm (PALM) to Buy from Hold, while lifting his price target to $14, from $8.70. Per a story posted by Eric Savitz on Barron's Tech Trader Daily blog, one of the factors leading to this move was the belief that the Street underestimates Sprint's commitment to Palm's success.

Check out the numbers being kicked aroundÂ… Arya thinks Palm could ship up to 2.5 million Pre smartphones in the 2009 second half and as many as 6.2 million phones in 2010.

To put that in perspective, in Q3 FY09 (which ended February 27), Palm's smartphone sell-through for the quarter was 482,000 units, down 42 percent year over year. In Q2 FY09, the sell-through was 599,000 units, down 13 percent year over year). In fact, the last time Palm eked out over a million units a quarter was Q1 FY09 -- 1,029,000.

I guess it is understandable why a 2.9 million number would get investors pumped. Just remember that just last Friday, Morgan Joseph presented reasons for pushing its rating in the opposite direction - namely, that the firm believed the "risk-reward isn't attractive" and the shares had peaked at the "virtual achievement of our $10.00 price target."

And the Pre watch continues...

Palm: Merrill Ups Rating To Buy; Sets $14 Target

Posted by

Bank of America/Merrill Lynch analyst Vivek Arya this morning upped his rating on Palm (PALM) to Buy from Hold, while lifting his price target to $14, from $8.70.

Arya contends the Street "underestimates Sprint's (S) commitment to Palm's success and [the] strength of the [the] underlying smartphone market."

He thinks Palm could ship up to 2.5 million Pre smartphones in the 2009 second half; for 2010, he thinks the company could ship as many as 6.2 million phones.

Arya also thinks the company has attractive M&A potential, trading well below the 2-4x sales paid in recent consumer electronics deals. But he also cautions that there is "a binary element" to his call, noting that the company is "critically exposed" to the success of the Pre. He also notes that there product adoption, execution and competitive risks - and that the company has a weak balance sheet with $323 million in cash, $395 million in debt, and a $90 million burn rate in the latest quarter. He thinks the company will burn another $136 million over the next three quarters, "which could necessitate dilutive capital raise or more extreme scenarios."

PALM today is up 22 cents, or 2.2%, to $10.06.